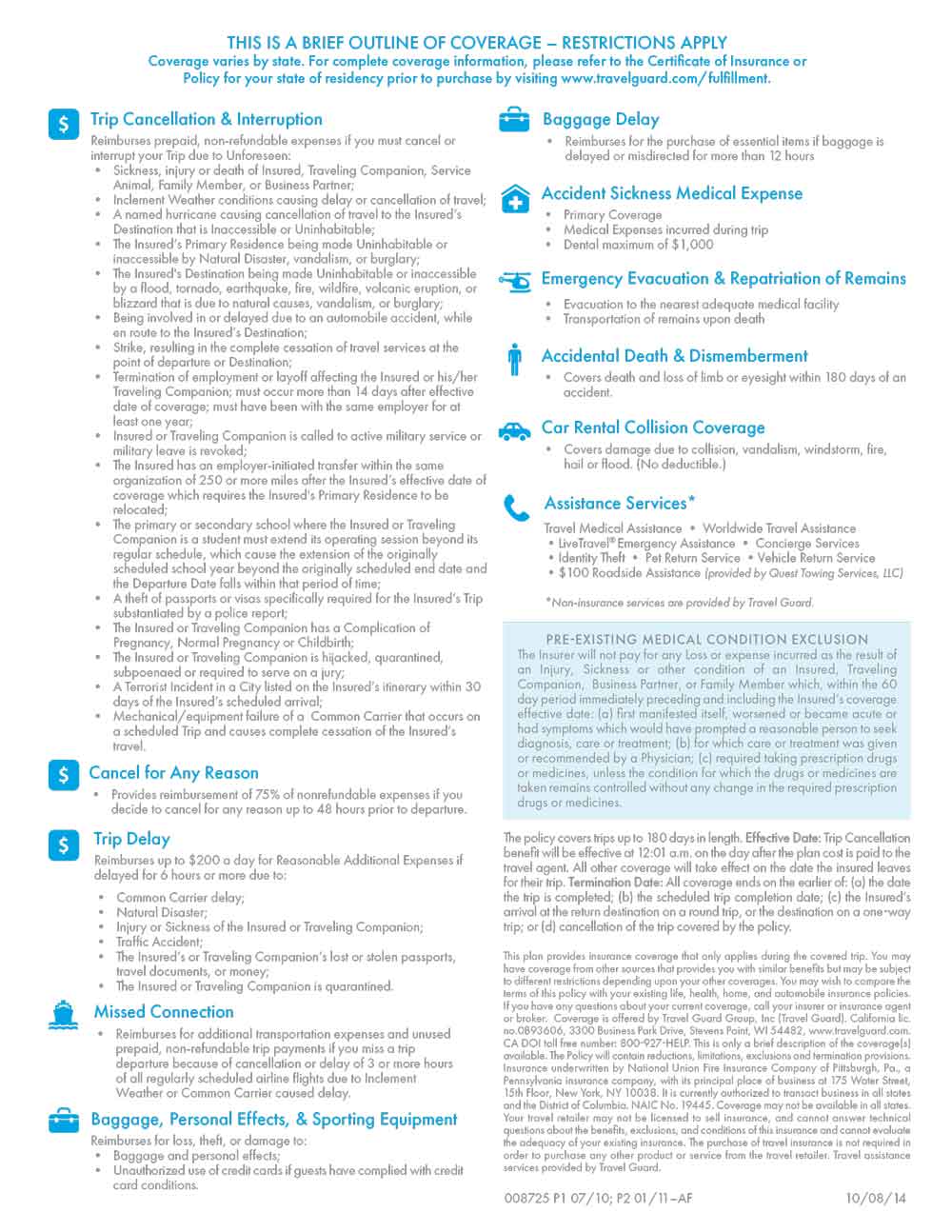

All Seasons Travel Plan with Cancel for Any Reason

With any plan you have 10 days to change your mind and get your money back. If you buy the insurance

and then see something you do not like you can cancel and get you money back with in 10 days.

NOTE: You must purchase the All Seasons Travel Plan with Cancel for Any Reason within 21 days of initial trip payment. The Pre-Existing Medical Condition Exclusion is waived. You must be medically able to travel when you pay your plan cost. Trip Cancellation & Interruption coverages are per booking. All other coverages are per person.

75% of non-refundable expenses Cancel for Any Reason

• The Insurer will reimburse 75% of pre-paid nonrefundable expenses if you

cancel your Trip for any reason, up to 48 hours prior to your departure. Coverage must be purchased for the full cost of all prepaid nonrefundable Trip arrangements.

Trip Cost – Trip Cancellation/Interruption

• Sickness, injury or death of Insured, Traveling Companion, Service Animal, Family Member, or Business Partner

• Inclement Weather conditions causing delay or cancellation of travel

• A named hurricane causing cancellation of travel to the Insured’s Destination that is Inaccessible or Uninhabitable

• The Insured’s Primary Residence being made Uninhabitable by Natural Disaster, vandalism, or burglary

• The Insured’s Destination being made Uninhabitable by a flood, tornado, earthquake, fire, wildfire, volcanic eruption, or blizzard that is due to natural causes, vandalism, or burglary

• Being involved in or delayed due to an automobile accident, while en route to the Insured’s Destination

• Strike, resulting in the complete cessation of travel services at the point of departure or Destination

• Termination of employment or layoff affecting the Insured or his/her Traveling Companion; must occur more than 14 days after effective date of coverage; must have been with the same employer for at least one year

• Insured or Traveling Companion is called to active military service or military leave is revoked

• The Insured has an employer-initiated transfer within the same organization of 250 or more miles after the Insured’s effective date of coverage which requires the Insured’s Primary Residence to be relocated

• The primary or secondary school where the Insured or Traveling Companion is a student must extend its operating session beyond its regular schedule, which cause the extension of the originally scheduled school year beyond the originally scheduled end date and the Departure Date falls within that period of time

• A theft of passports or visas specifically required for the Insured’s Trip substantiated by a police report 75% of non-refundable expenses Cancel for Any Reason.

$600 – Trip Delay (12 hours or more)

• Common Carrier delay

• Natural Disaster

• Injury or Sickness of the Insured or Traveling Companion

• Traffic Accident

This benefit is payable for only one delay per person per trip $1,000 – Baggage, Sporting Equipment & Personal Effects Reimburses for loss, theft, or damage to:

• Baggage and personal effects

• Unauthorized use of credit cards if guests have complied with credit card conditions.

$25,000 – Medical Expense

• Primar y Coverage

• Medical Expenses incurred during trip

• Dental maximum of $1,000

$1,000 – Baggage Delay ($200 per day)

• Reimburses for the purchase of essential items if baggage is delayed or misdirected for more than 12 hours

$1,000 – Baggage, Sporting Equipment & Personal Effects

Reimburses for loss, theft, or damage to:

• Baggage and personal effects

• Unauthorized use of credit cards if guests have complied with credit card conditions.

$25,000 – Medical Expense

• Primar y Coverage

• Medical Expenses incurred during trip

• Dental maximum of $1,000

$500,000 – Emergency Evacuation & Repatriation of Remains

• Evacuation to the nearest adequate medical facility

• Transportation of remains upon death

$100,000 – Accidental Death & Dismemberment

• Covers death and loss of limb or eyesight within 180 days of an accident

$25,000 – Car Rental Collision Coverage

• Covers damage due to collision, vandalism, theft, windstorm, fire, hail or flood

Assistance Services*

• Travel Medical Assistance

• Worldwide Travel Assistance

• LiveTravel® Emergency Assistance

• Detailed Pre-Trip Travel Advisories

• Concierge Services

• Identity Theft (Not available to NY residents)

• Pet Return Service

• $100 Roadside Assistance (provided by Coach-net Services Inc.)

*Non-insurance services are provided by Travel Guard

This is only a brief description of the coverage(s) available. The Policy will contain reductions,

limitations, exclusions and termination provisions. Insurance is underwritten by National Union Fire

Insurance Company of Pittsburgh, Pa., with its principal place of business in New York, NY. Coverage

may not be available in all states.

We also have a regular plan